Understanding the Different Types of GAP Insurance: Which One Suits Your Needs?

- 4 Mar 2025

Buying a car is exciting, but what happens if it’s written off or stolen before you’ve paid it off? That’s where GAP insurance comes in. It helps cover the difference between what your car is worth and what you still owe on your loan. Without it, you might end up paying out of pocket for a vehicle you can’t even drive anymore. But not all GAP insurance is the same, and choosing the right one depends on your situation.

What is GAP Insurance?

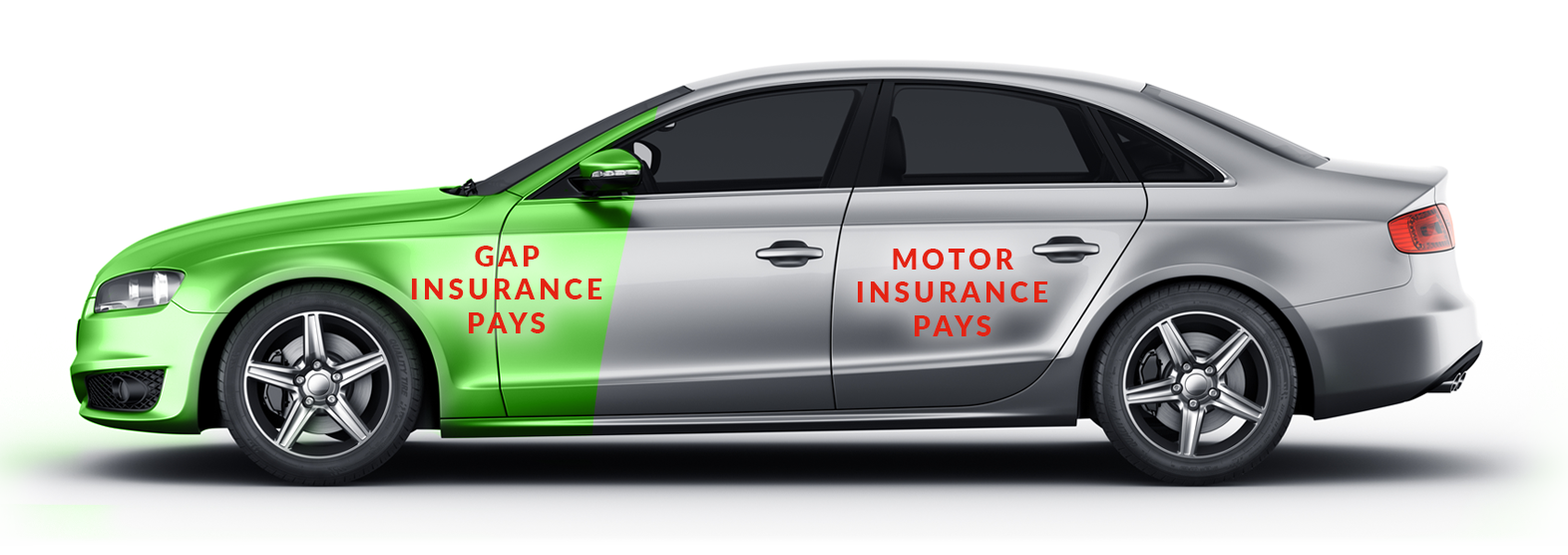

GAP is an acronym for Guaranteed Asset Protection. It is intended to shield vehicle owners from monetary losses in the event that their vehicle is deemed a total loss. Most standard auto insurance policies only cover the car’s current market value. The problem? Cars depreciate fast, and what you owe on your loan or lease might be much higher than what your insurer is willing to pay.

That’s where GAP insurance steps in, covering the shortfall so you don’t have to. But with multiple types available, picking the right one can be tricky. Some are tailored for leased cars, while others work best for financed vehicles. Let’s go through the different types so you can decide which one makes sense for you.

Finance GAP Insurance

This is the most common type, especially for people who’ve bought their car with a loan. If your car is stolen or written off, your regular insurer pays out the market value of the car. But what if that’s less than what you still owe the lender? That’s where Finance GAP insurance helps.

Imagine you bought a car for £25,000. A year later, it’s written off, and your insurer says it’s only worth £18,000 now. But you still owe £22,000 on your loan. Without GAP insurance, you’d be stuck paying £4,000 for a car you no longer own. Finance GAP covers that shortfall, so you’re not left paying for nothing.

This type is ideal if you financed your car with a long-term loan or put down a small deposit. The longer your repayment period, the bigger the gap between what your car is worth and what you owe.

Return to Invoice (RTI) GAP Insurance

If you’d rather get back what you originally paid for your car, this is the way to go. RTI GAP insurance covers the difference between your insurance payout and the amount you originally spent on the vehicle.

Let’s say you bought your car for £20,000. A couple of years later, it’s stolen, and your insurer values it at £13,000. That’s a £7,000 loss. RTI GAP insurance would cover that gap and bring your payout back up to £20,000.

This type is great if you bought a brand-new or nearly new car and want to recover your full investment in case of a loss. It’s also a good choice if you don’t want to end up with less money than you started with when looking for a replacement car.

Return to Value (RTV) GAP Insurance

This one works similarly to RTI, but instead of covering the original purchase price, it covers the car’s value at the time you took out the policy. This is useful if you bought a used car and didn’t purchase it from a dealer offering RTI GAP.

For example, if you bought a used car for £15,000 and a year later it’s written off with a market value of £10,000, RTV GAP would pay the difference to get you back to that £15,000 mark.

RTV is a good option if your car was second-hand but still worth a significant amount when you bought it. It helps protect the value you invested, even as the car depreciates.

Lease GAP Insurance

If you’re leasing a car rather than buying one, Lease GAP insurance is the right choice. When a leased car is written off, you might still be liable for payments or fees to the leasing company. This insurance covers that cost, so you don’t get stuck paying for a car you can’t use.

For instance, if your leased vehicle is worth £18,000 when it’s totalled, but your lease agreement says you still owe £22,000 in fees and payments, Lease GAP will cover the difference. This type is essential for leaseholders because standard car insurance won’t cover those extra charges.

Contract Hire GAP Insurance

This is another option for people who lease cars, especially those on a contract hire agreement. Unlike Lease GAP, which covers remaining payments, Contract Hire GAP covers any outstanding rental payments as well as early termination fees that leasing companies might charge if the car is written off.

If you’re in a long-term lease, this type of coverage prevents you from having to settle a hefty bill just because your car was stolen or totalled. Many leasing companies require this kind of coverage, so chequeyour contract before deciding.

Agreed Value GAP Insurance

This type is perfect for those who own classic or high-value cars. Instead of calculating payouts based on what your car was worth at the time of the accident, Agreed Value GAP lets you lock in a pre-determined value with your insurer when you take out the policy.

For example, if you own a collector’s car worth £40,000 today, but it’s hard to determine its exact depreciation over time, this policy guarantees that you’ll receive the full £40,000 if it’s ever declared a total loss.

This type is great for rare or vintage cars, where market values fluctuate. It ensures you’re not shortchanged if your prised possession is stolen or written off.

Which GAP Insurance is Right for You?

The right GAP insurance depends on how you bought your car, how much you still owe, and what you’d want in the event of a total loss. If you financed your car, Finance GAP is a solid choice. If you want to recover your full purchase price, RTI makes sense. For leased cars, Lease or Contract Hire GAP is the best bet. And if you own a valuable car, Agreed Value GAP will keep your investment protected.

Before choosing, cheque your loan details, leasing contract, or purchase agreement. Compare policies and decide which one aligns with your financial situation. A little planning now can save you a major headache down the road.

GAP insurance isn’t just another add-on—it’s a financial safety net. Cars lose value fast, and if something happens to yours, you don’t want to be stuck paying off a vehicle you no longer own. The right policy gives you peace of mind, whether you’re financing, leasing, or buying outright.

If you're looking for reliable coverage, Best4 Warranty has options that fit different needs. Cheque out their policies to find the right protection for your car today.

If you're looking for reliable coverage, Best4 GAP has options that fit different needs. Check out their policies to find the right protection for your car today.