What do I need to know before buying GAP Insurance?

There are certain criteria you may need to think about before buying GAP Insurance for your car.

- 4 Feb 2021

- Phoebe - Digital Marketing Assistant

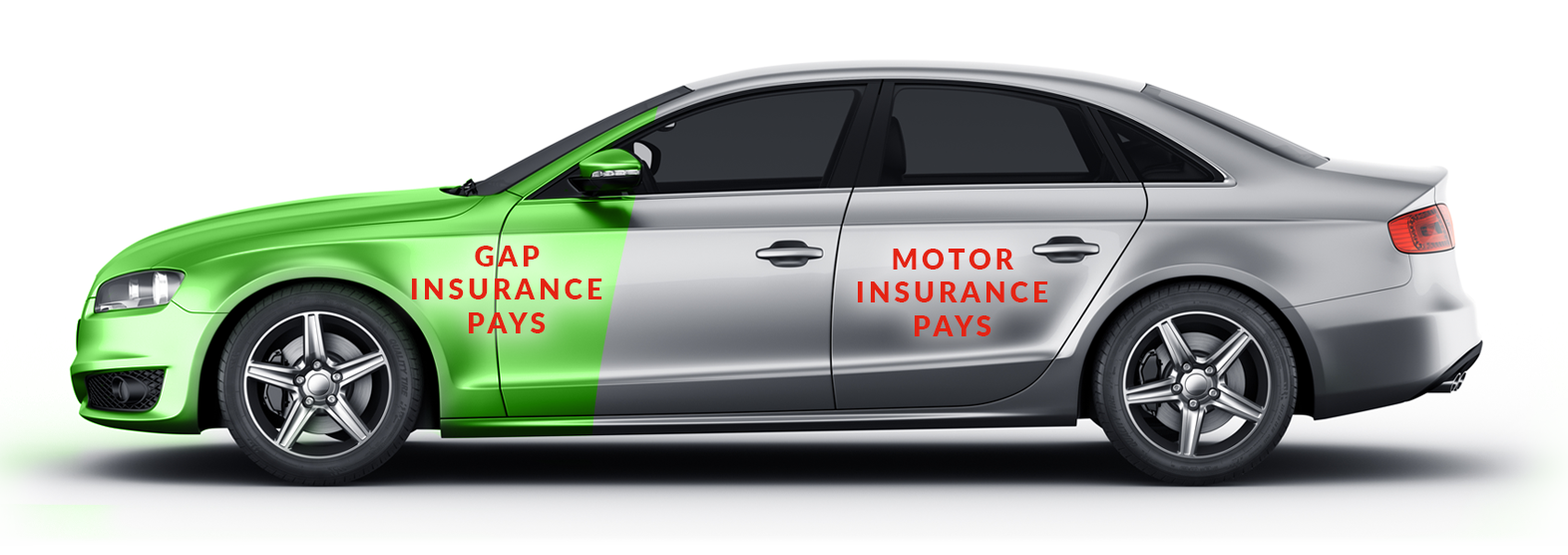

If your car is stolen or written on, GAP Insurance covers the gap between the price you paid for your car and the price your motor insurance company thinks your car is worth.

We’re here to tell you what else you should know before getting GAP Insurance on your car.

If you have purchased your car from a private seller, you will not be eligible for GAP Insurance. If you want to be able to get GAP cover, make sure to purchase your car from a VAT Registered Motor Vehicle Supplier.

We’ll need to know how you fund your vehicle: Hire purchase, PCP or Contract Purchase; Contract Hire or Finance Lease; or Cash Purchased, and (if applicable), your duration of finance.

Last but definitely not least, we’ll need to know how long you’ve owned your vehicle. If you’ve owned your vehicle for under 90 days - fantastic, you are eligible to purchase GAP Insurance. (0 days or over, unfortunately you will not be able to purchase.

How GAP Insurance works:

-

You buy a new car for £25,000

-

You buy 3-year GAP insurance policy

-

After 2 years car is damaged in a storm

-

Your vehicle is declared a total loss and you are offered £17,500

-

We cover the remaining £7,500 so you receive your full £25,000