Chevrolet GAP Insurance

Reliable Coverage for Chevrolet Owners

Chevrolet vehicles are a symbol of durability, performance, and style. Whether you drive a powerful Camaro, a versatile Equinox, or a rugged Silverado, every Chevrolet is built to deliver exceptional value. But like all vehicles, Chevrolets are subject to depreciation.

With Chevrolet GAP Insurance, you can safeguard your finances against unexpected events, ensuring peace of mind and uninterrupted driving pleasure.

.png)

Why Chevrolet Owners Need GAP Insurance

Chevrolet drivers rely on their vehicles for their dependability and versatility, but even the toughest trucks and most stylish sports cars depreciate over time. For example:

- A Chevrolet can lose up to 50% of its value within the first three years.

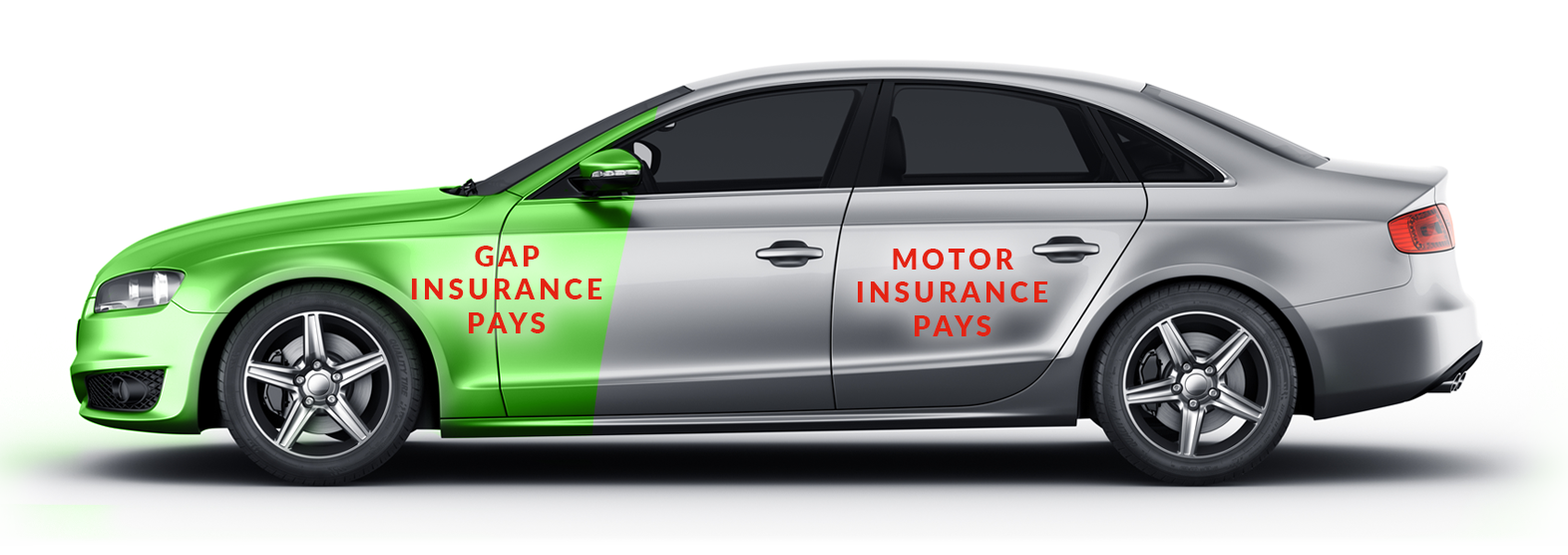

- If your car is stolen or written off, your insurer will only cover the current market value—not the amount you originally paid or owe on finance.

Chevrolet GAP Insurance ensures:

- The financial gap between your insurer’s payout and the original invoice price or outstanding finance is covered.

- Tailored protection for Chevrolet’s wide range of vehicles, from sports cars to SUVs and trucks.

- Peace of mind, whether your Chevrolet is leased, financed, or purchased outright.

Tailored Policies for Chevrolet Models

Our GAP insurance is designed to suit every Chevrolet model. Whether you drive the sporty Chevrolet Camaro, the family-friendly Equinox, or the heavy-duty Silverado, we’ve got you covered. Even compact options like the Chevrolet Spark or electric models like the Bolt EV are eligible for our tailored protection, ensuring your investment is secure.

How Chevrolet GAP Insurance Works

Here’s an example:

You purchased a Chevrolet Silverado for £40,000. Two years later, your vehicle is written off, and your insurer values it at £25,000. This leaves you with a £15,000 shortfall.

With Chevrolet GAP Insurance:

- We cover that £15,000 difference.

- You’re not left to bear the financial burden.

- You can continue enjoying your Chevrolet with confidence.

Key Benefits of Chevrolet GAP Insurance

- Comprehensive Financial Protection: Covers depreciation and financial shortfalls in case of theft or total loss.

- Tailored for Chevrolet Owners: Policies customised for trucks, SUVs, electric vehicles, and more.

- Flexible Terms: Choose coverage durations that fit your needs, up to 5 years.

- Affordable Premiums: Protect your Chevrolet without breaking the bank.

- Quick & Easy Claims: Get reliable support when you need it most.

How Much Does Chevrolet GAP Insurance Cost?

The cost of Chevrolet GAP Insurance depends on several factors, including:

- The make, model, and purchase price of your Chevrolet.

- The type of ownership: leased, financed, or outright purchased.

- The duration of your chosen coverage.

At Best4 GAP, we offer affordable rates to make premium protection accessible for every Chevrolet owner.

Get Your Personalised Chevrolet GAP Insurance Quote Today

Don’t let depreciation affect your Chevrolet ownership experience. Get your free Chevrolet GAP Insurance quote today and enjoy the confidence of knowing your investment is secure.

Get My Free Quote

Combination GAP

Most Popular

Get financially protected in case your vehicle is written off. While your motor insurance will only pay out the car’s current market value at the time of loss, Combination GAP Insurance bridges the gap by covering:

- The difference between the insurance payout and the price you originally paid for the vehicle.

- Any outstanding finance on your car loan.

Need a Hand? We're Here to Help.

Our team is here to support and guide you towards the best GAP policy for you.