Land Rover GAP Insurance

Premium Protection for Your Land Rover

Land Rover vehicles combine rugged off-road capability with luxury and sophistication. Whether you drive a Range Rover, the iconic Defender, or the versatile Discovery, owning a Land Rover is a testament to your adventurous spirit and appreciation for premium craftsmanship. However, even these exceptional vehicles are not immune to depreciation.

With Land Rover GAP Insurance, you can protect your investment and enjoy every journey with complete peace of mind.

.png)

Why Land Rover Owners Need GAP Insurance

Land Rover drivers expect the best in performance and durability, but even high-end vehicles experience depreciation over time. For example:

- A Land Rover can lose up to 50% of its value within the first three years.

- In the event of a total loss or theft, your insurer will only pay the vehicle’s current market value—not the price you originally paid or the remaining finance.

Land Rover GAP Insurance ensures:

- The financial gap between your insurer’s payout and the original invoice price or outstanding finance is covered.

- Tailored protection for Land Rover’s luxury SUVs and rugged off-road vehicles.

- Peace of mind for leased, financed, or outright purchased Land Rovers.

Tailored Policies for Land Rover Models

Our GAP insurance policies are designed to protect every model in Land Rover’s lineup. Whether you own a luxurious Range Rover, a robust Defender, or a family-friendly Discovery, we’ve got you covered. Even plug-in hybrids and electric models like the Range Rover Evoque PHEV are eligible for tailored protection, ensuring your Land Rover remains an investment in adventure and refinement.

How Land Rover GAP Insurance Works

Here’s an example:

You purchased a Land Rover Defender for £70,000. Two years later, your car is written off due to an accident, and your insurer values it at £45,000. This leaves a £25,000 shortfall.

With Land Rover GAP Insurance:

- We cover that £25,000 difference, ensuring you’re not left with a financial burden.

- You can enjoy your Land Rover with the confidence that your finances are protected.

Key Benefits of Land Rover GAP Insurance

- Comprehensive Financial Protection: Covers depreciation and financial shortfalls in case of theft or total loss.

- Tailored for Land Rover Owners: Policies designed for luxury, family, and off-road vehicles.

- Flexible Coverage Terms: Choose durations of up to 5 years.

- Competitive Premiums: Premium protection at rates that suit your budget.

- Hassle-Free Claims Process: Simple and efficient claims support when you need it most.

How Much Does Land Rover GAP Insurance Cost?

The cost of Land Rover GAP Insurance depends on several factors, including:

- Your vehicle’s make, model, and purchase price.

- Whether your Land Rover is leased, financed, or purchased outright.

- The duration of your chosen coverage (up to 5 years).

At Best4 GAP, we make premium protection affordable and accessible for Land Rover owners.

Get Your Personalised Land Rover GAP Insurance Quote Today

Your Land Rover is built to conquer any terrain—don’t let depreciation hold you back. Get your free Land Rover GAP Insurance quote today and drive with peace of mind, knowing your investment is secure.

Get My Free Quote

Combination GAP

Most Popular

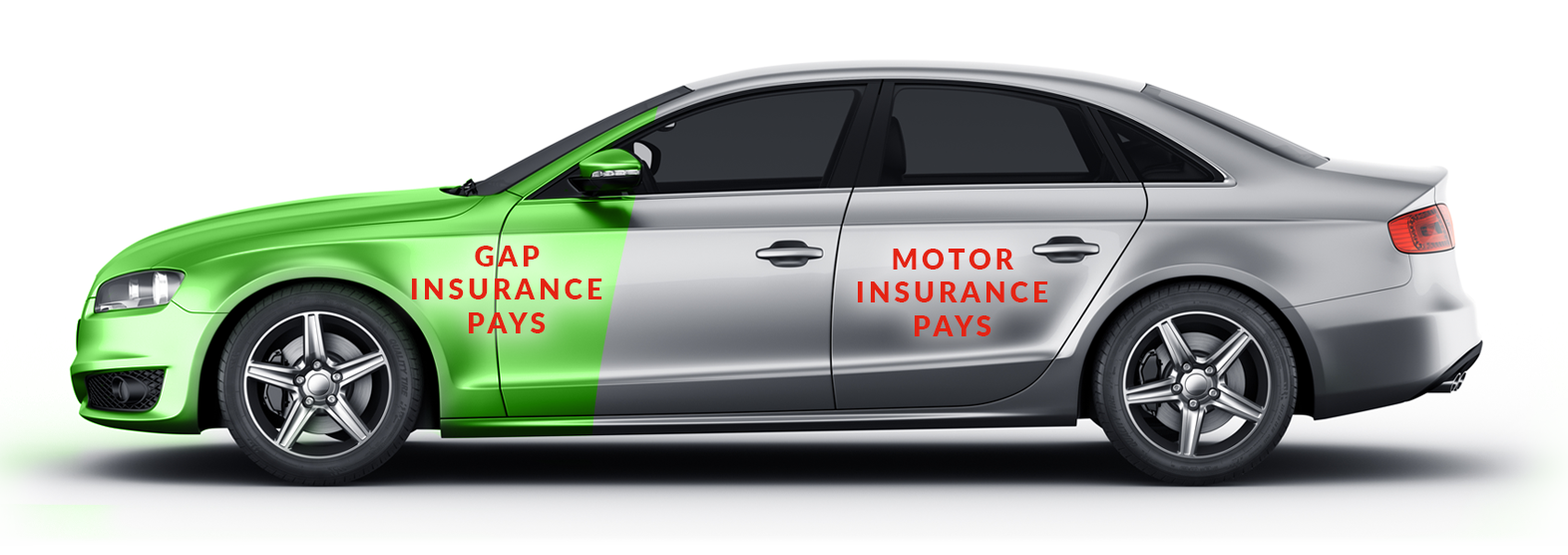

Get financially protected in case your vehicle is written off. While your motor insurance will only pay out the car’s current market value at the time of loss, Combination GAP Insurance bridges the gap by covering:

- The difference between the insurance payout and the price you originally paid for the vehicle.

- Any outstanding finance on your car loan.

Need a Hand? We're Here to Help.

Our team is here to support and guide you towards the best GAP policy for you.